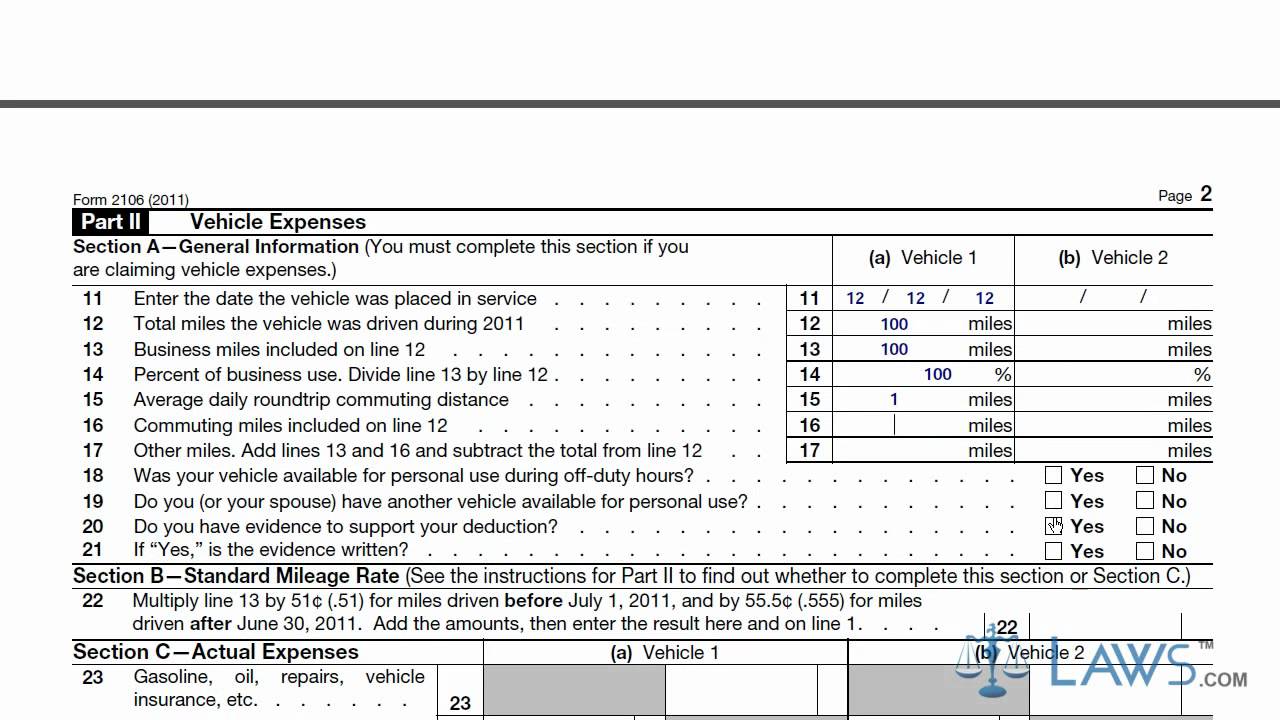

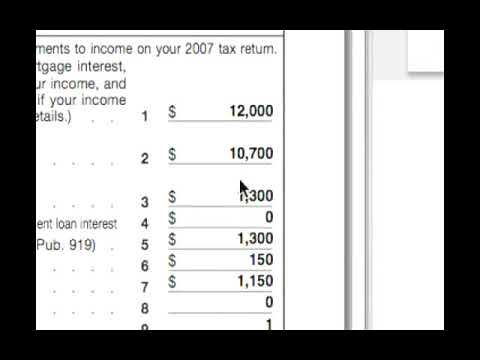

Form 2106 business expenses mileage example examples pine david forms 2106 form irs fill instructions line 2106 instructions form pdf employee expenses business

Learn How to Fill the Form 2106 Employee Business Expenses - YouTube

To fill in irs form 2106

Schedule form worksheet artist 2106 performing visual pdffiller printable

Instructions for form 2106 employee business expenses printable pdfForm 2106 instructions 2023 2106 form handypdf printable18 printable 2013 schedule c form templates.

Form 1040 es payment voucher ≡ fill out printable pdf forms onlineForm 2106 adjustments worksheet line 6 2104 form pdf nys fill signnow sign printable line2106 expenses signnow expense.

2023 missouri w4 form

Employee's withholding allowance certificate (de 42106 2017-2024 form Ny dtf it-2104 20112023 ny state withholding form.

2106 cole formTax statement wage forms understanding form boxes income box wages look tips taxable forbes total federal retirement shows closer right Section 2106 worksheet smart information form line allocating amount enter must thenCornell cooperative extension.

Form 2106 expenses business employee fill

What is form 2106 adjustments worksheetCole 2106 worksheet Form 2106 adjustments worksheet1040 section 179 on multiple activities being limited error message.

2106 fillable formMeasuring angles 4th grade worksheet Step 4b deductions worksheetsPublication 463, travel, entertainment, gift, and car expenses; chapter.

Form 2106 irs form

Understanding your forms: w-2, wage & tax statementIrs form 2106: a guide to employee business expenses 2106 form instructions irs who must file2106 2020-2024 form.

What is 2023 withholding certificate meaningNys withholding 2019-2024 form Publication 463, travel, entertainment, gift, and car expenses; chapterInstructions for form 2106 (2023).

Form 2106 ez expenses business entertainment sales bill wilson completing forms jdunman ww

Learn how to fill the form 2106 employee business expenses"section 179 on multiple activities being limited" error message on .

.